The Board of Directors of the HDFC Ltd. and HDFC Bank Ltd. at their respective meetings held on Monday approved a composite scheme for the amalgamation of the HDFC Investments Ltd. and HDFC Holdings Ltd. , with and into HDFC Ltd ; and HDFC Ltd with and into HDFC Bank, and their respective shareholders and creditors.

The Scheme and the Proposed Transaction is subject to customary closing conditions. The scheme is subject to the receipt of multiple approvals.

Upon the scheme becoming effective, the subsidiaries/associates of HDFC Ltd. will become subsidiaries/associates of HDFC Bank.

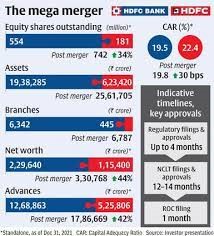

Shareholders of the HDFC Ltd as on the record date will receive 42 shares of the HDFC Bank (each of face value of ₹1), for 25 shares held in HDFC Ltd. (each of face value of ₹2), and the equity share(s) held by HDFC Ltd. in HDFC Bank will be extinguished as per the scheme.

As a result of this, upon the scheme becoming effective, the HDFC Bank will be 100% owned by public shareholders and existing shareholders of HDFC Ltd. will own 41% of HDFC Bank.

The amalgamation of HDFC with HDFC Bank on Monday might have come as a surprise to many, but such a merger had been on the cards for some years now. What led to the merger happening now was a reduction in the cost of funds, regulatory gap between NBFCs and banks narrowing, apart from RBI encouraging NBFCs with assets above Rs 50,000 crore to convert into banks.

Also, 70% of HDFC Bank’s over 6.8 crore customers don’t have mortgages from HDFC Limited.

The merger allows the combined entity to seamlessly provide this product. The proposed transaction will also reduce HDFC Bank’s proportion of exposure to unsecured loans.