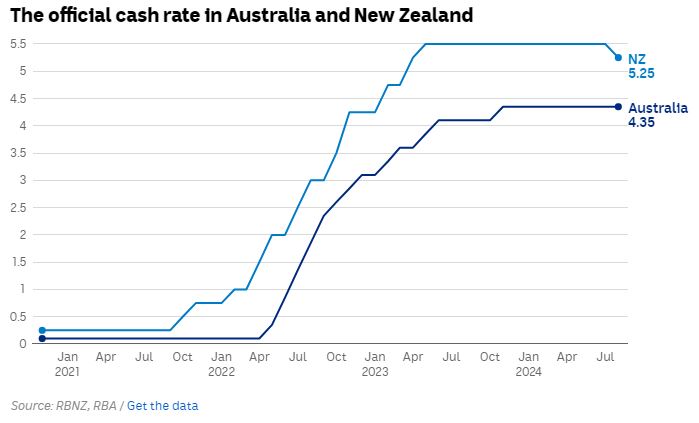

Auckland: New Zealand’s central bank recently cut the official cash rate (OCR) and hinted at further reductions, marking a significant shift in the country’s economic landscape. This decision, the first rate cut in over four years, signals a change in the monetary policy direction, which is expected to have notable effects on the housing market. Photo Credits: ABC News

A Period of High Rates: Benefitting First-Time Buyers

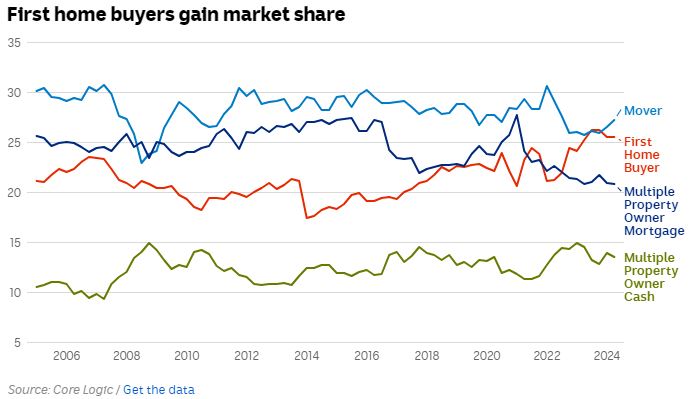

During the period of high interest rates, New Zealand’s housing market saw a unique trend. Despite the financial pressure, first-time homebuyers found themselves in a favourable position. With reduced competition from investors, who were deterred by the less attractive returns on rental properties, these buyers took advantage of the lower prices and greater choice available in the market.

Kelvin Davidson of CoreLogic New Zealand observed, “First-time buyers are very active right now. They’re pretty much running at record highs in terms of market share. The current conditions have provided them with opportunities that were not as accessible during the peak of the market.”

The Impact of Interest Rate Cuts on Housing

The recent 25 basis points reduction brings New Zealand’s OCR to 5.25%, with further cuts expected to bring it below 4.5% by mid-2024. This rate cut has already started to impact business and consumer sentiment, with increased optimism about the future and predictions of a 6% rise in house prices over the next year.

According to Sharon Zollner, Chief Economist at ANZ New Zealand, the rate cut represents a significant shift: “The first cut is the deepest. It marks a change of regime. The question is no longer if rates will fall, but how quickly they will do so.”

A Changing Housing Market

New Zealand’s housing market has faced challenges over the past year, with home values declining from their November 2021 peak. Despite these declines, the market is showing signs of recovery. Auction clearance rates in Auckland, a key indicator of market health, have started to rise in response to the lower interest rates.

Davidson noted, “There has been downward pressure on prices in most parts of the country this year, but the recent shift in interest rates seems to have encouraged buyer activity.”

The Road Ahead: Cautious Optimism

While the interest rate cut has improved sentiment, there are still challenges ahead. Financial stress remains a concern, particularly among older consumers with mortgages. However, the easing of inflation and the promise of further rate cuts are giving many New Zealanders hope.

Keith McLaughlin, Managing Director of Centrix, highlighted this cautious optimism: “People are starting to feel more confident, and this shift in consumer confidence is crucial for the recovery of the housing market.”

As New Zealand’s economy adjusts to the new monetary policy environment, the housing market is expected to stabilize and gradually recover. For first-time buyers, the current conditions continue to present opportunities, while investors may soon find the environment more favorable as rates continue to fall.